PayDirt

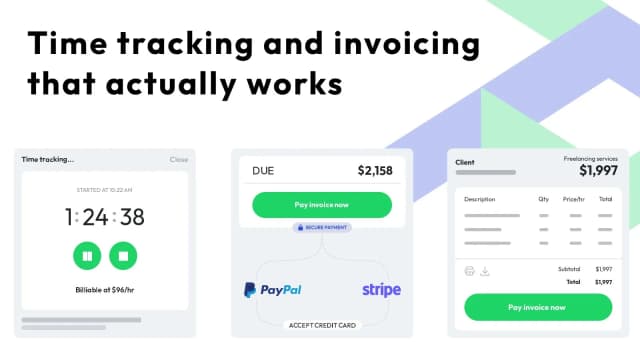

PayDirt is an intuitive time tracking and invoicing software designed specifically for agencies, contractors, and small teams. It streamlines the process of tracking billable hours, generating invoices, and managing payments, eliminating the common frustrations associated with traditional tools. With PayDirt, users can effortlessly monitor their work time, create professional invoices, and receive payments all within a single platform. The software emphasizes simplicity and user experience, ensuring that teams can focus on their work rather than administrative overhead. PayDirt also supports team management features, making it easy to collaborate and keep projects on track. Its online accessibility allows users to manage their finances and time from anywhere, enhancing productivity and cash flow management. Overall, PayDirt offers a modern, efficient solution for businesses seeking hassle-free time tracking and invoicing that truly works.

Share your honest experience with PayDirt

OOPPay

OOPPay is a cutting-edge crypto payment gateway designed to facilitate seamless USDT-TRC20 transactions for modern businesses. It offers under 30-second confirmation times and a low transaction fee of 0.5%, making it an efficient and cost-effective solution for online merchants. OOPPay enables businesses to accept cryptocurrency payments without requiring customers to connect wallets, simplifying the payment process while maintaining enterprise-grade security. Its simple REST API integration allows developers to quickly embed crypto payment capabilities into various platforms, including e-commerce sites, SaaS products, gaming, and digital services. With a focus on speed, security, and ease of use, OOPPay supports instant virtual goods delivery and microtransaction optimization, starting from as low as one dollar. This makes it ideal for industries that demand fast, reliable, and scalable crypto payment solutions. Whether for subscription billing, digital content, or in-game purchases, OOPPay empowers businesses to expand their payment options and embrace the growing cryptocurrency economy.

Tax Calculator PH

Free Philippines tax calculator. Calculate income tax, SSS, PhilHealth, and Pag-IBIG contributions. Get accurate take-home pay estimates for Filipino workers based on TRAIN Law 2025.

Authorize.Net

Authorize.Net is a leading payment gateway service that enables businesses to securely accept credit card and electronic check payments online. It provides a robust and reliable platform designed to simplify the payment process for e-commerce merchants, retail stores, and service providers. With features such as fraud detection, recurring billing, and advanced security protocols, Authorize.Net ensures transactions are processed safely and efficiently. The platform supports multiple payment methods, including credit cards, debit cards, and digital payment options, making it versatile for various business needs. Additionally, Authorize.Net offers easy integration through APIs and SDKs, allowing developers to embed payment processing seamlessly into websites, mobile apps, and other digital platforms. Its comprehensive reporting tools and customer management features help businesses track transactions and manage payments effectively. Trusted by thousands of merchants worldwide, Authorize.Net is a scalable solution that supports businesses of all sizes in delivering smooth, secure, and compliant payment experiences.

Invoice Downloader for Stripe

Invoice Downloader for Stripe is a secure, cross-platform desktop application designed to help businesses efficiently download, filter, and export their Stripe invoices in bulk. By connecting safely to your Stripe account via OAuth or API key, it allows users to filter invoices by preset or custom date ranges and export all selected invoices as PDFs bundled in a single ZIP file. This tool eliminates the hassle of manual downloads, saving valuable time for accounting, compliance, and record-keeping purposes. The app operates completely offline when using API keys, ensuring privacy and no reliance on third-party servers. Available for Windows, macOS, and Linux, it offers a one-time purchase license with no recurring fees, making it a cost-effective solution for professional invoice management. Its intuitive interface and advanced filtering options make it the fastest way to archive Stripe invoices securely and conveniently.

NextSaasPilot

NextSaasPilot is a comprehensive, production-ready Next.js SaaS starter kit designed to accelerate the development of scalable web applications. It offers a robust boilerplate with pre-built features such as authentication, payment integrations with Stripe and LemonSqueezy, and modern UI components built with Tailwind CSS and shadcn/ui. The platform supports TypeScript with strict type checking, Prisma ORM with MongoDB support, and seamless email service integration via Resend. NextSaasPilot provides a mobile-responsive design with dark and light theme support, SEO optimization, and production-ready deployment configurations, enabling SaaS entrepreneurs and developers to launch their products quickly and efficiently. Its extensive feature set reduces the time and complexity typically involved in building SaaS applications, making it ideal for startups and development teams aiming to bring their SaaS products to market in days rather than months.

2Checkout

2Checkout is a comprehensive global payment platform that enables businesses to accept online payments seamlessly and scale internationally. Acting as a merchant of record, 2Checkout handles payment processing, tax and regulatory compliance, and fraud prevention, allowing merchants to focus on growing their sales. The platform supports a wide range of payment methods including credit cards, debit cards, and PayPal, catering to customers worldwide. With robust APIs and integration options, 2Checkout facilitates smooth checkout experiences across websites, mobile apps, and marketplaces. Its global reach and localized payment options help businesses expand into new markets effortlessly. Additionally, 2Checkout offers subscription billing, recurring payments, and detailed analytics to optimize revenue streams. By managing the complexities of global e-commerce, 2Checkout empowers merchants to increase conversion rates, reduce payment friction, and ensure secure transactions across multiple currencies and countries.